Six Phases to Web3 Product Market Fit

Product Market Fit across Web2 and Web3

By Nitin Kumar

As the new market dynamics of 2022/23 unfold, the market is filled with tokens and projects on life support fighting to survive or retain value. Many of these projects, products, and platforms differ from web2 companies, they do not have focused teams to drive product- market fit (PMF). They use levers like incentives, tokens, and a movement-centered approach to branding. Web3 platforms begin their product-market fit journey with the distribution of utility tokens via airdrops or bounties creating a community-operated workforce. Permissionless product innovation, and leaderless movements e.g., Bitcoin and faceless branding are more nuanced than web2 traditionalists would care to understand. This article is focused on highlighting a few similarities and differences between web2 and web3 principles and practices.

Definitions

A practical path to product- market fit

There are no universally agreed-upon definitions of a product-market fit. However, everyone agrees that when the hard sales push becomes a pull from the market one can assume a fit is in place. Customers must come to you, use the product, and tell others about it!

Web3 is different and while many goals and principles remain like web2, the strategies and tactics deployed are different. Developing advanced technology does not mean use cases, business models or meaningful network effects emerge on their own. Each ecosystem must build a unique narrative, attract the right community to drive that narrative, and execute on multiple fronts to promote the narrative and growth.

Six phases to PMF

There are six broad and overlapping phases to achieve product-market fit, with key outcomes being the desirability, viability, and economic feasibility of the product. These six phases must be well- understood, executed, measured, and incentivized correctly.

1 : Progressive Decentralization

A term coined by a16z, it talks about three phases i.e., product-market fit by drawing the right initial users even during the time the product is controlled by the founding team, incentivizing more users by turning them into a community, and eventually turning operational control and decision making to the community. This is the first stage of the PMF i.e., attract the right community and scale slowly to decentralize continuing to bring in more of the right folks. This is the antithesis of the community built via ICOs where a whole bunch of speculators buy into the project and community who could be several degrees off a real fit. A compelling idea sold must be translated into a compelling vision and execution in the open market to have the right folks rallying behind it.

2 : Utility Establishment

Discovering and establishing utility takes time, experimentation, and an iterative process. Early community members prototype use cases, dApps, and engineer some utility into the tokens driving initial growth. When platforms, products, or protocols emerge from the early stages, foundational elements of utility must prove themselves e.g., locking resources, capital, and throughput into the token ecosystem. This is a critical path item to make sure the PMF is underway, these can be measured through various KPIs e.g., TVL (Total Value Locked), developer activity, etc. The liquidity and reliability of the base platform are determined through some of these key metrics. Then more users are attracted to the narrative, liquidity, reliability, growth, and robustness of the base platform establishing multiple utilities and ensuring a common goal to enhance it. The utility establishment phase also cements community participation, a critical path item without which the token will not gain momentum.

3 : Utility Momentum

Once the utility is established, it needs to be accelerated. For example, expanded uses cases such as collateralization, flash loans, burning, etc. through adding vectors of token programmability. Many protocols and platforms do not cross into this momentum phase of the PMF, some have activated a variety of momentum vectors e.g., DeFi, gaming, DAOs, etc. attracting different types of developers who can add multifaceted programmability and utilities adding momentum. DeFi and dApp building has shown the ability to drive momentum e.g., stablecoins, automated market makers, lending protocols, etc. A more composable infrastructure and platform layer must drive momentum, raw protocols seldom get here and Ethereum is a notable exception.

Most products and platforms fail because they cannot generate utility momentum.

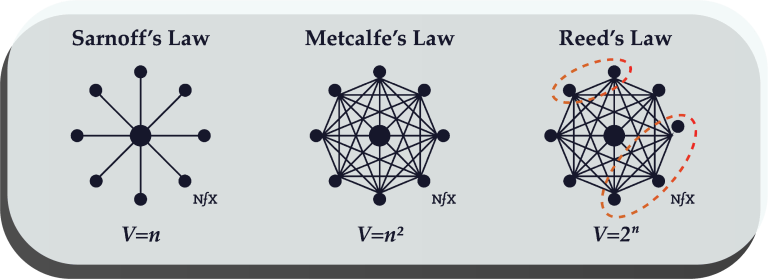

4 : Network Effect alpha (Metcalfe’s Law)

Network effects are the moat of any platform or protocol, they strengthen and accelerate functionalities around the thesis and narratives. Network effects e.g., Metcalfe’s Law i.e., more users, more usage, and more usage results in more users requiring a lot of work. For example, for users and usage to thrive one needs additional tools such as exchanges, wallets, media, and projects built on the base platform or protocol enriching the established token momentum and realizing value for it.

5 : Network Effect Beta (Reed’s Law)

There are no universally agreed-upon definitions of a product-market fit. However, everyone agrees that when the hard sales push becomes a pull from the market one can assume a fit is in place. Customers must come to you, use the product, and tell others about it!

Web3 is different and while many goals and principles remain like web2, the strategies and tactics deployed are different. Developing advanced technology does not mean use cases, business models or meaningful network effects emerge on their own. Each ecosystem must build a unique narrative, attract the right community to drive that narrative, and execute on multiple fronts to promote the narrative and growth.

Figure 1: Source: The Network Effects Bible

6 : The Economic Flywheel

Once the power of Metcalfe and Reed’s laws come together, it jumpstarts the economic flywheel which creates exponential growth for the platform or protocol e.g., Ethereum which has a token bootstrapped open-source network running on high- octane network incentives now. The more value created by community and ecosystems e.g., token holders (dapp development, marketing, core development, etc.), the more the demand for platform usage, building, and higher token prices – of course all prior steps must be executed well, and incentives of all participants must be aligned. Use cases like trading cards etc. can go viral once a platform has achieved this level of PMF, they become powerful mechanisms to attract and retain capital within ecosystems while creating more venues to trade and expand user bases on top of people who can already play with each other. Launching use cases like these on platforms even at the Network Alpha or Network Beta phase of the PMF is left to chances, it is nearly bullet-proof when launched at the flywheel stage.

Non- EVM (Ethereum Virtual Machine) blockchains have lot out on network effects. Many of the have launched initiatives to get EVM compliant.

Patterns and Metrics

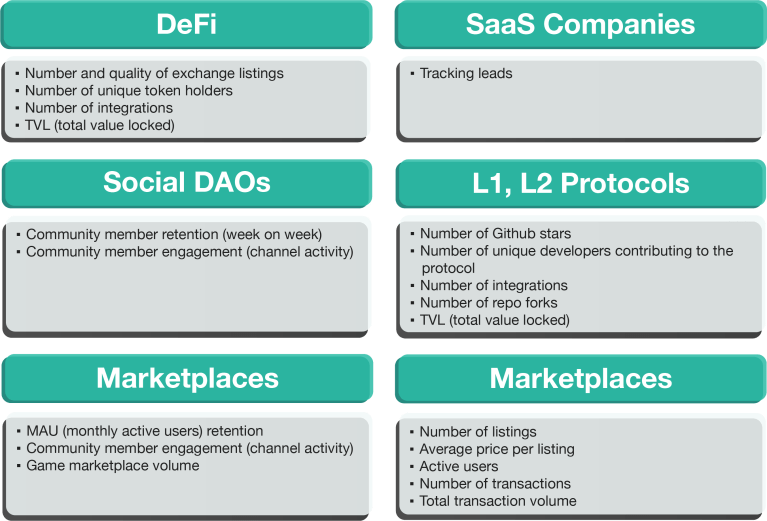

The metrics and patterns to determine PMF are clearer in Web2 and very granular in SaaS companies where sales cycle, leads, retention, churn rate, growth rate, etc. can indicate and dimension the level of fit. This is a little trickier in Web3. Given the relative immaturity of Web3, people homogenize single metrics across everything, and this is misleading and misguiding for new founders.

There are fitment metrics, operational metrics, and momentum metrics which do not count toward a PMF. For example, DAUs, MAUs, # of transactions, etc. are momentum metrics for the most part while items like burn multiple, productivity, etc. are operational metrics, most Web3 protocols do not even measure a lot of this yet.

Metrics vary in Web3 depending on the platform’s place in the value chain. Homogenous metrics never give out the right measure or fit.

Figure 2: Source: GTM IN WEB3 FROM FUTURE.COM

Key questions to assess PMF

- Do you understand the target market and understand where you fit in the value chain with existing players, users, and problems?

- Are you solving a problem that web2 cannot address (blue ocean)? If so, how big is the problem?

- Is your web3 product improving an existing web2 problem (red ocean)? If so, how big is the pain?

- Do you understand key metrics for product- market fit e.g., market share, unique developer contributions, monthly active users, developer/user retention, community engagement, TVL (for liquidity attracting products), etc.

- Do you measure what matters? For example, market share is not a good metric for blue ocean problems and user engagement is not a good metric for DeFi

- If you are a Layer 1, how will you capture the network effect without harnessing EVM capabilities to attract developers and liquidity

- Do you understand the similarities and differences between Web2 and Web3 product-market fit?

- Are you clear that Web3 principles are the same, but practices differ from Web2?

Sustaining PMF: healthy operational practices

A product-market fit is never constant, one must sometimes assess it through a competitive position, user retention, relative market share, etc.

Community Alignment

The web3 product-market fit starts with creating a community, this community must align with the founding team’s vision and drive it forward. Typically, visions turn into narratives by the community e.g., Ethereum is the world’s computer, bitcoin is digital gold, Solana is the consumer chain, etc. To execute well and drive adoption, the narrative, product releases, business development, and partnerships must always be aligned. Misalignment between these functional pillars can break the product-market fit. A purely financial incentive community will never cross the utility phase.

Communities built on pure financial incentives rarely succeed. Senseless airdrops create an illusion of a product- market fit eventually delaying or derailing it.

Sustainable revenue models

A good product-market fit must also align with the right revenue model. Web3 projects have three common revenue models i.e., revenue from the token burn, revenue from staking, and direct revenue from the product to fund the treasury. The first two models depend on the product-market or product-community fit and work well during bull markets but become unsustainable during bear markets killing the token utility, demand, and eventually its price. The product- driven revenue is more sustainable across bull markets (bull and bear) equally, however, it must drive natural demand based on alignment between the four functional levers.

Focus on Standalone Value

Having liquid tokens on a project’s balance sheet does not mean the achievement of a sustainable product- market fit, speculators could destroy the project. Products must show a tangible ability to generate free cash flow to the platform or protocol, this is typically driven by network effects not just by buying growth through tokens for a short-term spike. While airdrops are good to catalyze the first traction, they also create an illusion of a product-market fit. Investors are also shifting focus to user monetization, not bought-out growth.

Investors view equity as claims to future cash flows and profits (minus liabilities) and tokens as value created from future utility or services delivered by the protocol.

Given the relative maturity of the market, many protocols have not charted a clear path to sustain value through future delivery of utility, causing a shift in investor mindset. Investors are now emphasizing the quality of revenue, which can raise the value of their equity profile while eventually accruing token value. The more value dedicated to the protocol, the higher its liquidity, and reliability. Real utility always attracts engagement, investment, and energy from the community producing an adoption flywheel by the community.

Be hypothesis-driven, not speculation-driven

Being hypothesis-driven is far better than being speculation driven. Web3 is new and nascent with a lot of whitespaces to create value. Good product- market fit principles are rooted in a sound hypothesis that gets proven or pivoted to create value and scale. For example, obvious gaps like interoperability, enterprise privacy, usability, appchains, etc. are good starting points for a hypothesis. Further honing down to specific problems in that hypothesis and discovering a unique proposition in the value chain rather than launching something narrative-driven attracting speculators.

Being useful, Being usable

There have been limited web3 products and platforms which solve real-world problems and there is also an ocean of “me too” players lacking differentiation. If products claim differentiation, they have mostly been differentiated narratives, not execution. Web3 products must be beyond narratives and promises. Many Laye1 protocols are in raw form and take a lot of work to make them usable, web3 products also have never focused on UX aspects, design, or usability making adoption difficult. Being useful and usable in the real world i.e., web2 world. Many web3 products are focused on “future value” than “real value”, this creates nothing useful in the current state.

Web3 will succeed when integrated into everyday lives of people. One does not have to go battle with Web2 for it.

Work alongside web2

Web3 products are construed to build an open, transparent, decentralized, immutable, and user- owned internet. However, this does not mean everything in web2 has a problem requiring these attributes. There are core gaps in web2 e.g., centralized platform power, walled gardens of value, opacity, illiquid assets, and single points of compromise, etc. which web3 products and platforms can solve. There is also increased security, new forms of collaboration, new asset classes, and new business models not previously possible in web2. Products need not solve a specific, new linear problem; they can solve the existing problems in a new way. Web2 migrant product managers should change their mindset to not just think about problems to solve but think about what web2 cannot do (that web3 can), what web3 can do better than web2 and where web2 and web3 together create an exponential effect. This differs from traditional product management where one is laser-focused on a single problem to solve, web3 is a range of issues and use cases that might not fully replace web2.

Accept some realities; web3 is not going to rip and replace web2 overnight.

The regulatory chasm

Regulatory uncertainty is one of the big challenges in Web3, some jurisdictions are putting frameworks in place but overall, we have a long way to go. The ethos of the narrative and promise is the tokens will have utility in the future – the community must execute this promise to follow the current regulatory framework. The founding teams must face the challenge of removing themselves from decision-making early and handing over core operations to the community to achieve “sufficient decentralization”.

Fair distribution

Actions must align with promises with meaningful stakes distributed with the right contribution level. Airdrops alone have not been proven to be the method to determine product-market fit. Other possible vectors are aligning developer commits, developer gamification, participation levels, market share, etc. driving the right signature of the community versus speculation-driven developers. Stakeholders must also be empowered to experiment with new utility vectors and demand.

Concluding thoughts

The product or platform fit in web3 is a new phenomenon where decentralized code governs the conditions for the creation and capture of value via tokens. The best platforms with market fit are those that have optimized the interaction model between ecosystem participants to enhance functional utility and demand. The product-market fit journey is also not a slam dunk like in Web2, it can be fraught with community fractures, narrative divergences, political forks, rigid stances on upgrades, etc. Even successful web3 giants like Bitcoin and Ethereum have gone through their own set of challenges with markedly different narratives today than when they began.

Start your Web3 journey today with zbyte.